osceola county property tax estimator

Yearly median tax in Osceola County. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744.

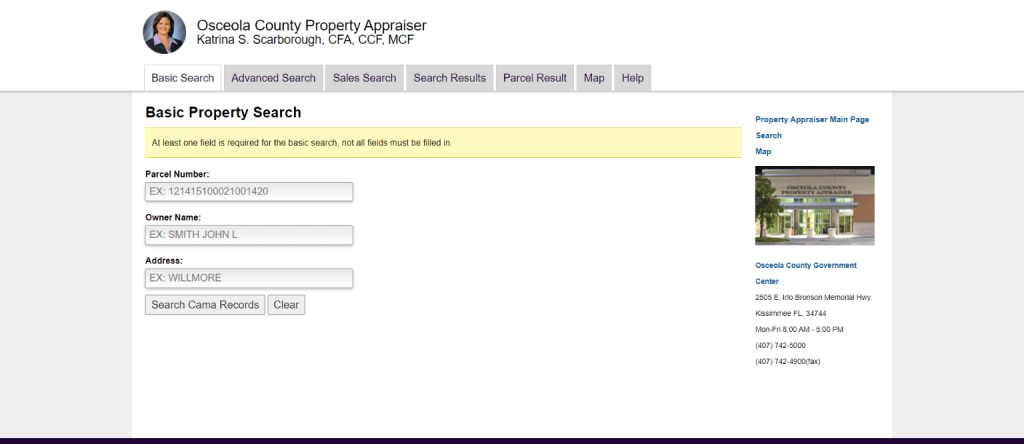

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser

If you are contemplating.

. For comparison the median home value in Osceola County is 10110000. 407-742-4037 Property Taxes FAX. View full property information.

2781 BOAT COVE CIR KISSIMMEE FL 34746. The purchase price of County-held certificate is the face value plus interest at the rate of 15 per month beginning on June 1 of the certificate year normally the calendar year following the tax. Homeowners in Pinellas County pay a median.

Osceola Tax Collector Website. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Search all services we offer.

AGRICULTURAL SPECIAL - 6948 AIRPORTSTRANSIT TERMINALMARINAS - 2011 APARTMENT CONDO - 0341 APARTMENT CONDO COMMON. OSCEOLA COUNTY TAX COLLECTOR PHONE. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. PRII PLEASANT HILL ASSOC LLC. 3845 PLEASANT HILL RD KISSIMMEE FL 34746.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. Osceola County Property Appraiser. Please fill in at least one field.

407-742-4009 Local BusinessTourist Tax. Tangible Department 2505 E Irlo Bronson Memorial Highway Kissimmee FL 34744. 3807 PLEASANT HILL RD KISSIMMEE FL 34746.

Current Ad Valorem Taxes. You may submit a detailed asset listing in Excel format on CD. Visit their website for more information.

This Tax Estimator is intended to assist homesteaded and non-homesteaded property owners estimate future taxes and understand the impact of amendments to the Florida State. 105 of home value. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist.

407-742-3995 Driver License Tag FAX. If you need to find your propertys most recent tax assessment or the actual property tax due on your property. 095 of home value.

Osceola County Property Appraiser Attn. The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay.

For comparison the median home value in Osceola County is 19920000. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. The Tax Collectors Office provides the following services.

Yearly median tax in Osceola County. Pinellas County sits between Old Tampa Bay and the Gulf of Mexico and has property taxes well below both state and national averages.

Your 2019 Notice Of Proposed Taxes And Proposed Millage Rates Are Now Available On Papa

Osceola County Fl Property Tax Search And Records Propertyshark

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Florida Wikipedia

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Parcel Result Parcel 092529101300010030 Osceola County Property Appraiser

The Osceola Chamber Kisschamber Twitter

Orlando Hotel Tax Rates 2019 Tax Rates For All Of Florida

Osceola County Property Appraiser How To Check Your Property S Value

Florida Property Tax H R Block

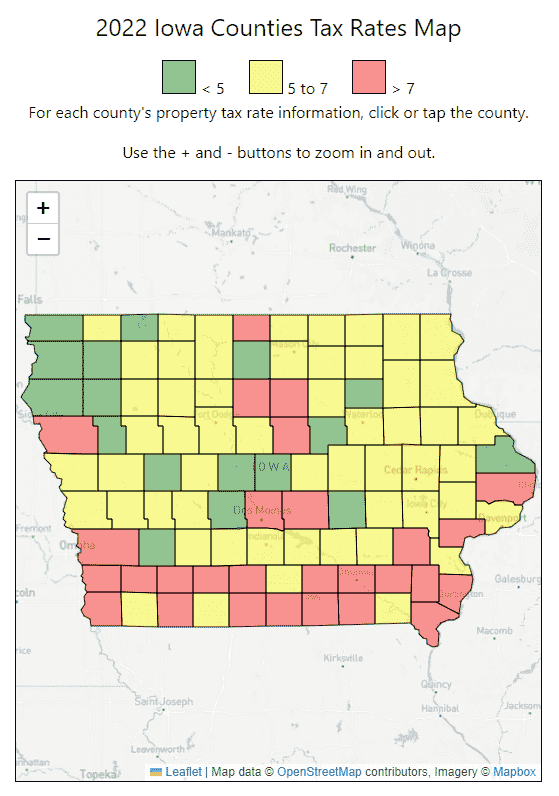

2022 Iowa County Property Tax Rates

Property Tax By County Property Tax Calculator Rethority

Live From The Osceola County Emergency Operations Center Hurricane Ian September 28 10am This Briefing Will Be Presented In English In Its Entirety And Then The Same Information Will